Crowd Control with Blockchain Thinking

You’d be forgiven for being totally sick of hearing about Bitcoin. From ridiculous valuations of $1000+ per virtual unit, to gross devaluations, to abstract cryptographic concepts, to money-as-speech arguments, to startup lists as long as your arm, it all seems a little too unbelievable. And it is, of course. That’s if you can put up with the almost extremist, radical, and quasi-anarchical behaviour of its proponents, who tend to rant about destroying the Fiat currency system after a few drinks.

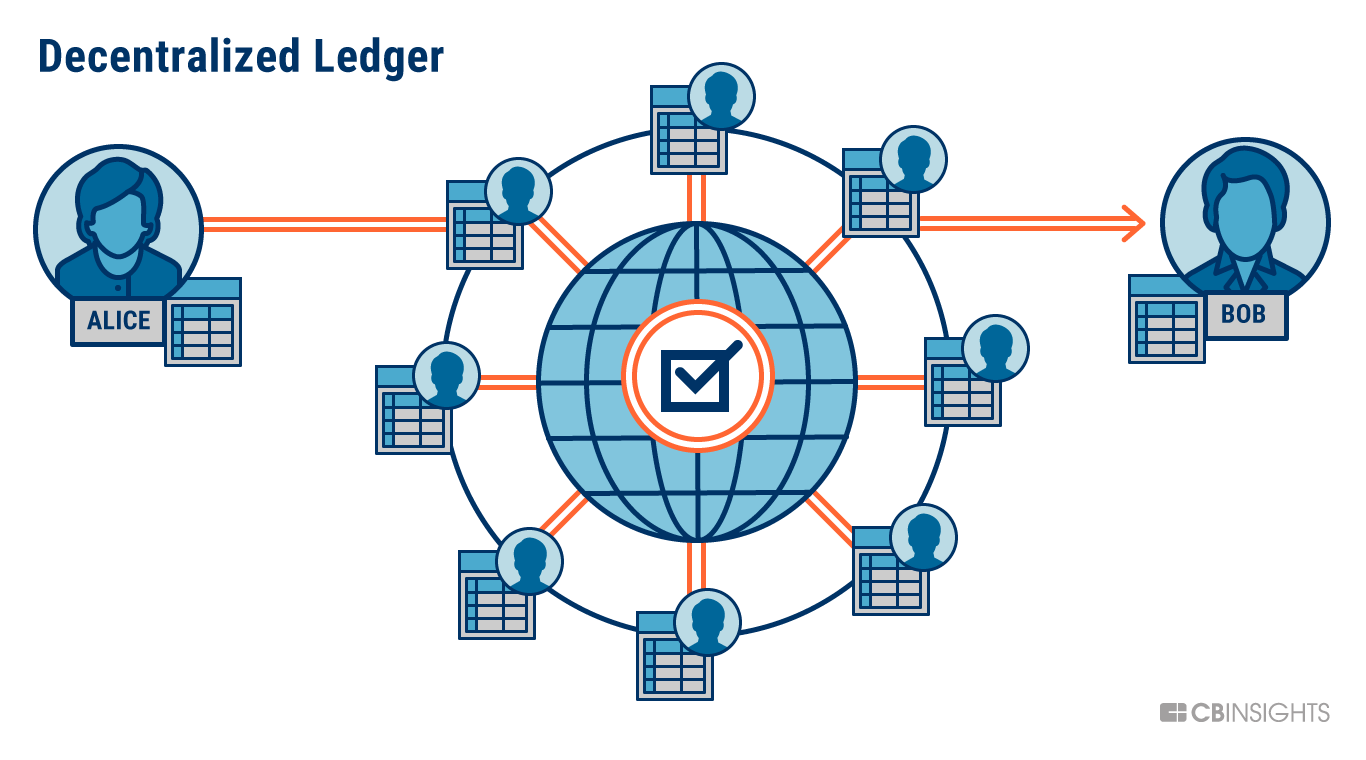

There is no doubt that money’s future is entirely digital, but you don’t need [insert-any-currency-name]-coin to understand that. Only 3% of Sweden’s transactions now involve physical promissory notes or coins; tourist resorts, such as Atlantis in the Bahamas, are already cashless. Money in the computer age is simply a set of numbers; debits and credits recorded in networked ledgers. Card processing simply moves numbers from one database record to another.

But if you thought that, you’d miss the genius of what the Blockchain itself is a solution to. It’s nothing to do with money.

The Blockchain provides a way for a chaotic crowd to automatically makes decisions for itself.

Nakamoto, — whomever you believe him, or them, to be — solved an extraordinary problem: how to you get a mob to reach consensus?

If you have anarchy, and no-one trusts each other, how do you get an irrevocable agreement without a central middleman to count the votes?

The fundamental math challenge as expressed by Microsoft PhDs (http://research.microsoft.com/en-us/um/people/lamport/pubs/byz.pdf) is known as the “Byzantine Generals Problem”, and was originally presented as:

We imagine that several divisions of the Byzantine army are camped outside an enemy city, each division commanded by its own general. The generals can communicate with one another only by messenger. After observing the enemy, they must decide upon a common plan of action. However, some of the generals may be traitors, trying to prevent the loyal generals from reaching agreement. The generals must have an algorithm to guarantee that

A. All loyal generals decide upon the same plan of action.

The loyal generals will all do what the algorithm says they should, but the traitors may do anything they wish. The algorithm must guarantee condition A regardless of what the traitors do.

The loyal generals should not only reach agreement, but should agree upon a reasonable plan. We therefore also want to insure that:

B. A small number of traitors cannot cause the loyal generals to adopt a bad plan.

From Lamport, Shostack and Pease, “the Byzantine Generals Problem”, ACM Transactions on Programming Languages and Systems,Vol.4, No. 3, July 1982, Pages 382–401.

In this scenario, the fundamental problem is human nature itself — i.e. trust. None of the generals can trust each other, but they all need each other to resolve the dilemma. Almost all systems — particularly security — have the prerequisite that some parts intrinsically trust others. A mob is the same: the entire crowd needs to come to consensus, when the individual members are inherently for themselves, or against others.

What we see in this absurdly-abstract world of academics, is that the problem that’s being solved is something we’ve been lacked for all of humanity’s history: a method for a disorganised, chaotic crowd of people — who don’t trust each other at all — to come to a proven consensus to abide by, with absolutely no need for a trusted middleman to validate the result. A middleman who wields all the power, and is frequently corrupt.

We take for granted every day the sheer, colossal amount of social and economic systems that entirely depend on a middleman to co-ordinate mob processes we can barely think of operating any differently. Government and banking are the most obvious, but when we begin to scrutinise the pile, we’re looking at almost everything — any form of hierarchical structure, such as the military, corporate entities, regulators, courts, arbitrators, and so on.

Voting. Contracts. Property. Any form of transaction. And of course, money. Money’s the hardest problem of all: an exchange of virtualised debits and credits on a ledger. But it’s actually just the same problem.

We now have a way to co-ordinate that mindlessly chaotic mob, that also completely negates the corruptibility of the middleman. Cryptography makes the result irrevocable, simply due the mathematics.

The answer proposed by the Blockchain solution is the simple concept of “Proof of Work”. Each of the generals must spend time to complete a complex task that the others can irrevocably verify. The fact they took time to calculate the solution indicates their inclusion, and the solution validates it was related to the previous transaction. Although Blockchain systematics themselves are difficult to comprehend at points, the fundamental precept is that transactions are math puzzles (guesses) that are then organised into groups, or “blocks”, which follow on from each other — creating a verifiable public “chain”.

All of the mechanisms we take for granted everyday suddenly no longer need a counter, or a reference. Take queues, for example: who allocates the position and gives you your number? The man at the door. No need for that person anymore. The number-allocator has been replaced by a distributed ledger that anyone can verify — with certainty in the figures.

Ownership is no longer in one piece of paper, but in a verified chain that anyone can check, right back to its origin. No-one needs to go to one person or authority — e.g. the bank — to testify to the integrity of their claim. Independent units — often disorganised — have a structured way to work together. The entire network acts together to provide the integrity of the chain itself, rejecting transactions that do not fit.

Who secures it, of course, is a different question.

Money is just the beginning of Blockchain applications, because it’s the hardest and most central problem. The secret of this mathematical brilliance is in a much deeper problem most of us don’t even realise exists, as we’re so used to putting our trust in Law to regulate authorities that our daily lives rely on.

Grecian Democracy itself immediately comes under the spotlight. Consider the debacle of a Senate in complete disarray, for an issue such as, let’s pontificate, universal healthcare. That insanely discordant mob of politicians wanting to record an agreement between untrusting parties that is entirely definitive, with the added spectre of anonymity. No need for a speaker to count; just a chaotic mob submitting their represented views into the public ledger, for any constituent to scrutinise. Expand that even further: 300M+ people submitting their digitally-verifiable opinion whenever they wish.

Film could be the most profound recipient of this technology. Imagine a business where a chain of ownership, credits/attribution, or temporary rental ownership, could be an entirely automated affair: filmmakers could be paid for every time their intellectual property was shared via software that supported the same ledger, without the need to implicitly verify that copy of said property was legitimate, because of the original chain of ownership.

Virtually any problem that involves a disorganised, chaotic crowd can be resolved with a Blockchain solution — provided it can cope without a real-time (i.e. within 5mins) answer. Very few situations in human life actually require a resolution with that immediacy, save for ATMs and nightclub admittance. Even then, the Blockchain process itself is tweak-able enough to deal with second-by-second crowd control if the technology is customised. $100M can be smuggled across the border on an SD card, or uploaded anywhere in seconds.

And that comprises the secret power of the Blockchain — a concept so obscured in technological acronyms and academic talk, that its true value has so far been quietly abstracted in the frantic over-excitability of the socially-awkward systems administrators who proselytize it. Just as Graphene has yet to start reaching its commercial potential, so the decision-making systems of the world have yet to be twisted around by the idea the participants can do it themselves.

The engineering currently being developed to support and empower this new decentralized world is nothing short of contained genius.

Just as work on so-called “Onion Routing” (i.e. anonymized Tor browsing) began in 1995 before the Internet was commercialised, so will digital currency (i.e decentralized public ledger-keeping) be decades ahead of the recognised modern world in 10 years’ time. With plain-text HTTP came the need for anonymized web connections to avoid surveillance, and with decentralized electronic money, comes the need to protect ordinary humans against the overlords who would seek to control what the Proles are able to contribute to from day-to-day.

The first endemic issues we can see already since the spread of decentralized accounting, are, of course, the human ones of theft, and fraud. The so-called “double-spend” attacks, hacking of digital vaults, and tracking down of drug dealers’ transaction histories through the ledger(s). The idea of “CoinJoin” was surpassed by “DarkSend” (now part of Dash) to deliberately anonymize transactions so they cannot be traced.

It may take thirty years for the middle classes to understand the basic usefulness of an automated way to organise the mob, but when it does dawn, it would have been too late, as the Big Guys who were threatened by it in the first place would have integrated it into our Mainstream life. And that is what we are seeing right now, as 30+ banks deploy resources to invest to control Blockchain technology before they are out-dated by it: http://www.reuters.com/article/us-global-banks-blockchain-idUSKBN0TZ1MF20151216 .

It’s going to be fascinating to watch how a centralized force (i.e. government) will attempt to use the centralized ideas of legislation and regulation to control a system that is designed to behave in a uncontrollable, decentralized way.

The importance of the Blockchain idea is in the way we think about the processes that control wide aspects of our lives, and how we use technology to cope with human nature itself. Mathematics can entirely change how we feel about political decision-making, once the middleman representative is removed. Transactions are promises made from party to another that effectively comprise speech. Large corporate entities who have caused irreparable social damage, e.g. mindless Wall Street profiteers, need no longer have the monopoly on financial systems.

In the perpetual power struggle between centralized public bodies, and the decentralized chaos of the competitive Free Markets, lies the public. Maybe, someday in our lifetime, we will see a government afraid of its people, rather than the historically inverse continuum.